As an entrepreneur, operating your day-to-day business and planning for the future can consume a lot of your time. Paying less tax, although important, may not always be top of mind.

There’s no time like the present to ensure you are taking full advantage of all the tax minimization strategies available to you. As tax season approaches, here are some tips to get you started.

1. Employ your spouse and children. Whether you carry on your business personally or through a corporation, you should consider paying a salary to your spouse and/or children. Paying a salary to a spouse or child who pays tax at a lower rate than you can create net tax savings. But you must ensure that the salary is reasonable for the services they perform for the business.

2. Incorporate your business. If your business produces more profit than necessary to satisfy your personal cash flow needs, then incorporation could produce a sizeable tax deferral by accessing the lower small business tax rate for active income. This deferral benefit, however, is only available if the profits are left in the company. The longer the profits are left in the company, the larger the tax advantage.

3. Invest excess cash. Since the biggest bang for your tax buck is accomplished by leaving profits in the company, the question becomes what to do with those profits. If paying down debt or reinvesting in the business isn’t an option, then a smart investment plan is your best alternative. This strategy is most effective for active business income, which is subject to the small business deduction.

4. Plan for your retirement. Build your wealth with a registered retirement savings plan (RRSP) or a tax-free savings account (TFSA). These strategies can help you achieve balance in your personal investment plan. An investment consultant can help you determine how your contributions will fit within this year’s maximum contribution limits.

5. Prepare for the sale of your business. It’s never too early to plan your business exit strategy. If you’re planning on selling all or part of your business at some point, confirm with your accountant whether you’re eligible for the lifetime capital gain exemption and what steps need to be taken.

Unfortunately, we can’t eliminate taxes. But we can use wise business practices to minimize or defer income taxes that would otherwise be payable. These are only a few of the tax-planning opportunities available to you as a business owner. By working with an investment consultant, you can get a complete tax check-up to help identify all the tax-planning strategies available to you.

Operation Red Nose Gearing Up for Holiday Season

Nov 21, 2024 | 9:48 pm

For the St. Malo chapter of Operation Red Nose (ORN), 2024 marks the fifth year that they’ve been providing safe rides throughout southeast Manitoba, helping keep everyone safer on the...

Read moreFor the St. Malo chapter of Operation Red Nose (ORN), 2024 marks the fifth year that they’ve been providing safe rides throughout southeast Manitoba, helping keep everyone safer on the...

Read moreNiverville Approves Automotive Businesses and Anticipates Planning Sessions

Nov 20, 2024 | 2:50 pm

At its November 19 public meeting, Niverville’s council approved conditional use applications for two new automotive businesses, both destined for the Niverville business park. The first...

Read moreAt its November 19 public meeting, Niverville’s council approved conditional use applications for two new automotive businesses, both destined for the Niverville business park. The first...

Read moreProvincial Throne Speech Presents Things to Come in New Year

Nov 19, 2024 | 11:00 pm

On November 19, Lieutenant Governor Anita Neville read the 2024 speech from the throne, a document outlining the NDP government’s plans for the coming year. The event closed with a performance...

Read moreOn November 19, Lieutenant Governor Anita Neville read the 2024 speech from the throne, a document outlining the NDP government’s plans for the coming year. The event closed with a performance...

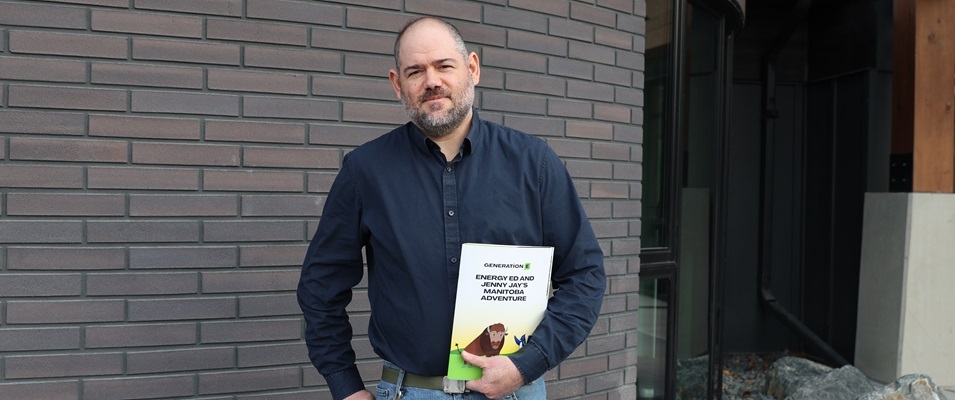

Read moreRitchot’s Energy Efficiency Advocate Promotes Provincial Programs, Rebates

Nov 19, 2024 | 3:45 pm

Uriel Jelin’s is a relatively new face at the RM of Ritchot’s municipal office and he’s there to fill the role of Energy Efficiency Advocate. His position began in early summer. “This is...

Read moreUriel Jelin’s is a relatively new face at the RM of Ritchot’s municipal office and he’s there to fill the role of Energy Efficiency Advocate. His position began in early summer. “This is...

Read moreCanada Post Strike Disrupts Mail Delivery

Nov 18, 2024 | 5:38 pm

On Friday, November 15, approximately 55,000 postal workers across Canada Post walked off the job, bringing mail and parcel deliveries to a virtual standstill. Only government benefit cheques...

Read moreOn Friday, November 15, approximately 55,000 postal workers across Canada Post walked off the job, bringing mail and parcel deliveries to a virtual standstill. Only government benefit cheques...

Read moreProvince Invests in New Crime Prevention Strategies

Nov 15, 2024 | 5:57 pm

The provincial government has rolled out a new public safety strategy, the goal of which is not only to address violent crime and retail theft but also to zero in on the root causes of these crimes...

Read moreThe provincial government has rolled out a new public safety strategy, the goal of which is not only to address violent crime and retail theft but also to zero in on the root causes of these crimes...

Read moreProvincial Government Introduces Cabinet Changes

Nov 13, 2024 | 11:58 am

Beginning November 13, the NDP has shifted the faces and portfolios of several cabinet positions. At the same time, new cabinet ministers have been added, as well as one new department: the...

Read moreBeginning November 13, the NDP has shifted the faces and portfolios of several cabinet positions. At the same time, new cabinet ministers have been added, as well as one new department: the...

Read moreNiverville High School Reports Positive Response to Cellphone Ban

Nov 13, 2024 | 11:47 am

It’s been just over two months since the province banned student cellphone use in schools and Niverville High School’s principal, Paul Grosskopf, reports that the transition is going remarkably...

Read moreIt’s been just over two months since the province banned student cellphone use in schools and Niverville High School’s principal, Paul Grosskopf, reports that the transition is going remarkably...

Read moreIf a community-to-community bus service was offered at a reasonable rate in rural Manitoba, would you use it?

For related article, see https://nivervillecitizen.com/...