The cost of groceries is going up and there is a complex network of reasons why. Whether you see it as inflation, supply shortages, or gas prices, dinner table discussion has recently turned toward the topic of what’s on the dinner table and how much it cost to get it there.

Food prices are always on the move. Oftentimes these prices are regulated by the government, and we may hear about these changes on the news as regulatory boards make changes that affect the entire population in one stroke.

Other price changes seem to happen without notice and are accepted as the natural consequences of seasonal factors on organics, supply and demand, and climate change.

Invariably, prices are expected to go up. And sometimes they head back down.

When prices go up, and only up, and sometimes by large margins, that causes people to sit up and take note.

“Over the past two years we have experienced an overall increase in phone calls from people desperate for food,” says Yoni Coodin, social innovation coordinator for Food Matters Manitoba (FMM), a not-for-profit organization that addresses food security and provides resources and support in Manitoba. “We don’t really have a way to monitor the factors that contribute to this month-to-month, but we have noticed anecdotally that calls dropped off significantly when federal COVID-19 relief programs—CERB, CEWS, CERS, Emergency Food Fund, etc.—were introduced and have resurged since the end of those programs.”

According to FMM’s website, more than 14 percent of Manitobans, 60 percent of northern residents living on-reserve, and more than one in five children across the province experience household food insecurity (HFI), meaning they don’t have enough money to buy food.

Because of the pandemic, sustaining the same food purchasing habits has become challenging for many households, perhaps for the first time ever.

“COVID-19 has intensified the financial precariousness that drives poverty along with household food insecurity,” the FMM says on their website. “It is experienced disproportionately by Indigenous and Black households. COVID-19 has brought food security and household food insecurity to the forefront of a necessary, and long overdue, national conversation. In truth, the pandemic has simply drawn attention to concerns regarding food security and equity that have been around much longer.”

Food Assistance

Niverville Helping Hands (NHH) is a not-for-profit that provides food assistance to those in need in Niverville, New Bothwell, Otterburne, and Ste. Agathe. In 2021, the organization reported that they were serving more than three times the number of requests for food assistance than they had been before the pandemic.

At Christmas time, the need for food increased again and has not decreased.

“Since Christmas, the level of need has remained the same,” says Larissa Sandulak, board chair for Niverville Helping Hands. “If fuel and grocery prices continue on this track, the need might increase again. However, I’d guess it’s still too early to be seeing the effects on our end.”

Sandulak says she has noticed grocery prices increase, making it even harder for those living on lower or fixed incomes.

“The primary demographic that we serve were already living on budgets spread very thin,” says Sandulak. “The rising grocery and fuel costs will only increase the strain on their budget.”

She says that Helping Hands will continue to be in communication with clients and will strive for new ways to provide grocery support.

“As needs change, we are open to increasing our support, as well as creative and out-of-the-box ways for us to serve them,” says Sandulak.

Managing Expenses

For the average household, the pandemic produced in people a wide variety of new concerns surrounding their role in public health, at-home education, and socialization for family members of all ages.

On top of these concerns, some households experienced the loss of income due to the downturn in the economy.

Danae Doerksen says that she’s thankful COVID did not affect her family’s income streams negatively, but the price of gas and groceries remains a concern.

“I do not feel like our gas spending increased that much. With the combo of working remote and in-office, it did not seem like more was spent,” says Doerksen. “Groceries are going up, but some of that I just equated to kids growing up and eating more and prices increasing during the winter season. But I have realized that the prices of meat and vegetables [has gone up].”

She says she and her family try to cut back on grocery spending in a number of ways—such as buying generic brands, using points, buying in bulk, and comparing costs in flyers—in order to make every dollar go a little farther.

To save money on gas, Doerksen says she tries to pay attention to when items go on sale at the local grocery store, Niverville Bigway.

“I try to reduce the number of times I go into the city to buy groceries and instead shop sales in town when it comes to meat, veggies, and other things that I need to tide me over until the next shop,” says Doerksen.

Although she used to feel enough freedom to buy out-of-season produce, she now realizes that upwardly mobile prices have influenced her to avoid buying higher-priced items at certain times of the year.

“Lots of my buying groceries is subconscious,” she says. “For example, I realize I haven’t bought strawberries as a ‘treat’ for a while because there was never a good enough sale to warrant the impulse buy. Or the avocadoes. They just haven’t been worth it.”

Meal planning and gardening are other tactics she uses to stay ahead of the curve. She also makes some of her own bread products.

“I plan my meals according to the sales I encounter that week,” she says. “I am planning what I am planting in my garden to help with meals and have already frozen some handmade burgers for summer when I saw a sale on meat. I try to make handmade items as much as possible and have started to make buns again during the pandemic.”

The Cost of Freight

While the nature of grocery pricing is complex, record-high gas prices have certainly added fuel to the discussion.

But Tim Plett, owner of Plett Trucking in Landmark, says that it would be a mistake to think prices at the grocery store are going up because of gas.

“To me, that is perpetuated by sensation. To me, everything is logic and it’s simple math,” says Plett. “If you go pick a supply lane from any point, for example, from Toronto to Winnipeg, right now the cost of moving is extremely high. From everywhere, it’s extremely high. And those costs will come down.”

Plett says it is more exciting to talk about gas prices as an obvious reason for pricing to go up—and people like to get angry.

“Talking about fuel is sexy; talking about supply and demand is not,” says Plett. “Demand drives freight up and then it’s a bidding war. People are bidding for your services and that drives prices up because guys are bidding for your truck.”

Plett admits that freight costs have gone up, but he points to supply and demand as the dominant factor. He explains that protests and other COVID-related delays impacted goods trying to come in from all directions, as well as the catastrophic flooding that happened in British Columbia. Weather-related highway closures in Manitoba this winter also put intense pressure on moving food and other goods within the province.

“It started in the fall, in the west coast and the atmospheric rivers that destroyed highways,” says Plett. “There were 400 loads of freight waiting in Vancouver waiting to come west. Now it’s at 17. So that’s more normal. In Manitoba, we’ve had an extremely difficult winter because of snowstorms and truck availability. The snowstorms are the biggest thing. In the last 30 years, we get maybe one blizzard a year. This year, we’ve had 10. Every week, we’ve had one or two or three days of road closures. If you take two days worth of production out of the mix, we’re all two days behind. The freight still needs to go, but we’re two days behind.”

According to Plett, the issue of truck availability is a more important factor than the cost of fuel. He also suggests that grocery retailers are raising prices by too great a margin.

“If we double our freight rate, then the store sees the cost go up and they raise the price,” he says. “It’s the store that is price-gouging and they are lining their pockets. We were accused of this, going back six or seven years ago when we had something like this happen and the cost of oranges almost doubled. Safeway and Loblaws doubled their profit margin on that. If someone sees they are paying $1 per pound more, the fuel cost went up about ten cents per pound for us. So that’s the grocery store raising their price unnecessarily. The transporation industry is absolutely not responsible for the price hike at the store. We get a small, small percentage of that.”

Plett says that the trucking industry’s responsibility in the supply chain from farm to grocery store is to survive on incremental increases and keep costs low.

“I know how much it costs to get it from point A to point B,” says Plett. “From the farmer’s field to the grocery shelf, I know the total transportation cost. Is the grower doubling their income? No. So where is it coming from? It’s the store. It’s the bigger chain stores, and then the smaller stores follow suit because they can.”

From a capitalistic perspective, Plett says that this is simple supply and demand. Retailers will charge what consumers are willing to pay.

A Hypercompetitive Industry

John Schmidtke, owner of Niverville Bigway, agrees that we are all seeing the result of supply and demand. But he most certainly does not agree that the grocery stores are raising prices unnecessarily.

Schmidtke says that he sets his prices based on the hypercompetitive nature of the industry. Grocery stores must make money in order to continue to meet the growing needs of a growing community. Without the ability to make a profit, there would not be a grocery store in town to serve its residents.

“In the grocery industry, pricing is more or less set at a profit percentage that is standard across the country,” Schmidtke says. “It’s different at different times, yes, and at any store, if you’re looking at the flyer, grocery stores aren’t making money on the flyer items. Those are the things that are on sale. Those are the best prices for consumers, and they make money on the other regularly priced items based on a percentage throughout the year.”

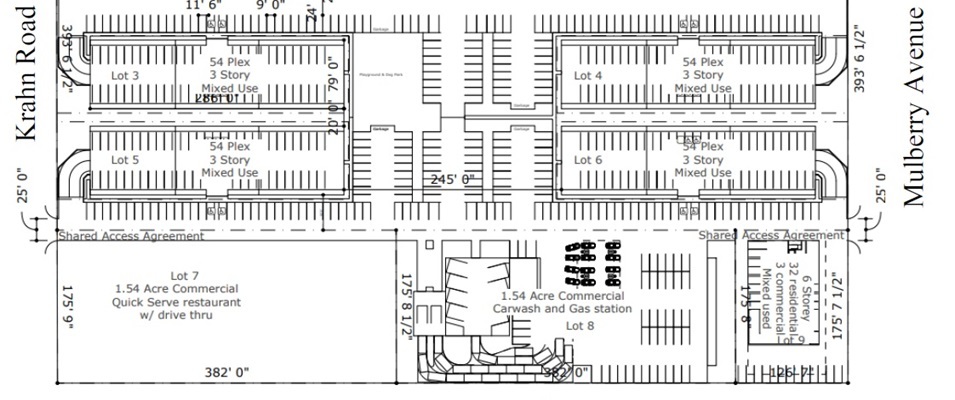

Schmidtke says that his prices are based on a percentage that is required to cover overhead costs, the basic cost of the food itself, the cost of theft or damaged items, and a contingency to ensure that the store’s planned expansio projects will allow them to continue serving Niverville in the coming years.

“It should be noted groceries are a competitive industry, so competition affects the pricing to draw customers in and keep the business affloat,” says Schmidtke.

And how does the cost of gas affect him as a small-town grocer?

“Freight affects any industry that is in the goods sector, because goods have to be shipped,” he says. “Every good has to get on boats and trains and trucks. There’s not a lot of examples in the goods sector where things don’t have to be transported, and so everything is affected by the price of fuel. Groceries are in particular affected by fuel because a lot of equipment is required to get it off of fields to process it. That all gets passed on to the consumer.”

Schmidtke says that it’s unfortunate that everyone is pointing the finger at everyone else. The food supply chain is seeing increased cost at every level and no one in particular is to blame.

For example, Schmidtke says that if a product goes up in price by 70 cents, there’s a good reason for it.

If a product goes up by 70 cents, he explains, it’s because 10 cents goes to the farmer who is producing the eggs. He asks for more money because he has taken a hit on the cost required to produce those eggs, like fuel to haul feed using his feedtruck or run the equipment necessary to produce his own crops for feed. Then another 10 cents goes to paying a truck driver and covering the fuel bill to take his eggs to the processing plant. Then there’s the cost to transport the eggs to the central warehouse, and yet more cost to get it to the grocery store.

“At every level the cost is seen incrementally, and that’s business,” Schmidtke says. “There are no truckers or farmers who are doing business today who aren’t still trying to make money. In hypercompetitive industries, and if you look at a long-haul truck driver, the net profit at the end of the year as a percent of revenue is almost always less than five percent and usually less than two percent. If the price of fuel goes up 15 to 20 percent and they don’t change their pricing, the’ll be losing money. Everyone has to change their pricing. It has to get passed to the consumer because everyone along the line has to raise their price.”

As far as the large grocery companies go, Schmidtke does not believe the profits for these companies have increased to a large extent.

“The profit percentage for the industry giants has stayed the same, like Superstore Walmart, Sobeys,” says Schmidtke. “Loblaws is a publically traded company and their grocery retail financials is separated out from some of their other industry. Their financials are public. You can see what their profit is. I guarantee you their profit is not up 70 percent. If a person wanted to do the research to look into it, look into the publically traded companies and see. It’s all there. No one in the industry is going from two to three percent net profit to a seven to eight percent net profit. No consumer goods company, no highly competitive industry, is doing that.”

There are products with set prices that are regulated by external governing bodies outside the grocery stores. Schmidtke says that liquor and milk are two products where he does not have any control over the prices, but he still provides the shelf space, staff support, and other overhead costs to act as retailer for those items.

“Milk is regulated by the dairy board and I think it is a four-percent markup for grocers that is approved,” says Schimdtke. “But I have to pay for an upgrade to coolers, electricity to run the coolers, staff to cart it in. Jugs leak or break or the date goes by. And I have to sell other product to make up the difference in that loss. We buy the milk at the cost of $6.13 for a four-litre jug and $6.15 is the consumer cost. We make two cents per gallon of milk.”

Schmidtke says that keeping his business running with a profit is crucial, but he also understands that the price of groceries going up creates stress for many. He tries to maintain an active presence in the community and give back where he can.

“I’m aware of the perception that small-town grocery stores are too expensive,” he acknowledges. “This is what we are all facing, and this is often the reality of hypercompetitive consumer industry when prices go up. And gas is actually the same thing. There’s no gas station out there where the gas station owner is making a lot of money. That percentage is dictated by the market of what your profit percentage can be as a business owner to attract customers and keep your doors open.”